RBA cuts rates to 0.5%. Time to review your rate?

- LoanCaddie

- Mar 3, 2020

- 1 min read

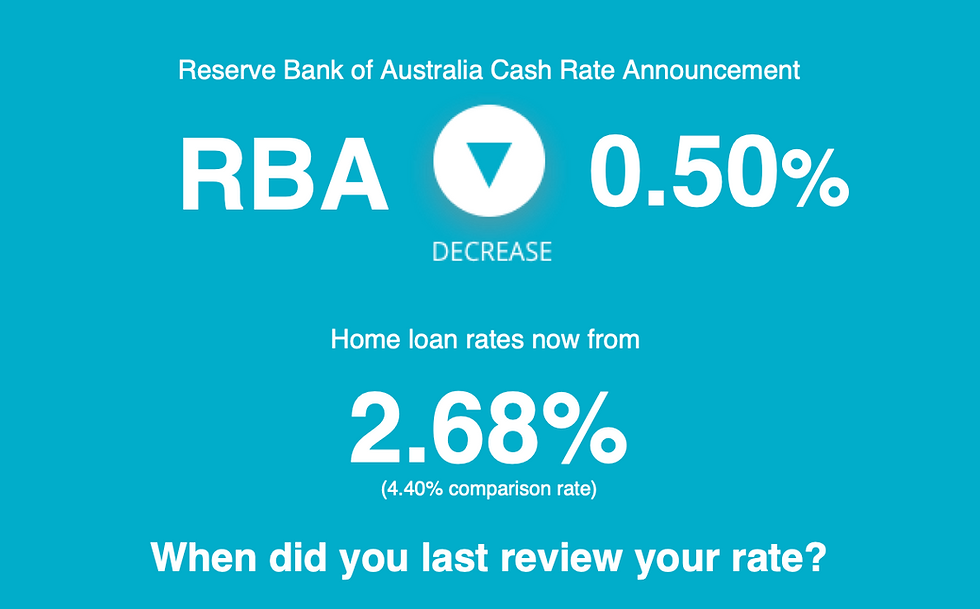

While the autumn wind blows colder, things are heating up in the property market as the Reserve Bank of Australia (RBA) decided to slash the official cash rate to a historic low of 0.50% at its meeting today.

At the previous meeting, RBA governor Philip Lowe said that despite expectations of stronger global growth this year, the recent coronavirus outbreak has become a source of uncertainty. "In the short term, the bushfires and the coronavirus outbreak will temporarily weigh on domestic growth." He also said that we may expect an extended period of low-interest rates. "The Board will continue to monitor developments…It remains prepared to ease monetary policy further if needed," Lowe said.

When did you last review your rate?

The cash rate is the lowest it’s ever been and lenders are offering competitive rates to help you achieve your property goals. Everyone can do with extra savings in their pocket. If you haven’t reviewed your interest rate in the last 6-12 months you may be paying too much and could stand to save thousands. Get in touch today!

1. Comparison rate calculated on a loan amount of $150,000 over a term of 25 years based on monthly payments, including a package discount (if applicable). These rates are for secured loans only.

WARNING: This Comparison Rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.